You have a choice; you have options. Know your rights!

Talk to an expert and learn about your Medicare choices.

Medicare Plans

When considering your Medicare options, you can spend hours doing your research, or you can make a single call to Next Health & Medicare Solutions. We’ll search thousands of plans from nationally recognized companies to find the coverage that’s right for you at a price that fits your budget. And we’ll do it at no cost to you.

Medicare Overview

In general, Medicare provides health insurance for people age 65 or older. Certain people younger than age 65 can qualify for Medicare, but there is specific qualifications that need to be met. Contact us if you are under 65 and trying to qualify for Medicare.

It is important to know that Medicare helps with the cost of health care, but it does not cover all medical expenses or the cost of most long-term care. Medicare Supplement Insurance (Medigap) policies from a private insurance company can help cover gaps in Medicare coverage.

The Parts of Medicare

Original Source ssa.gov

Social Security enrolls you in Original Medicare (Part A and Part B).

- Medicare Part A (hospital insurance) helps pay for inpatient care in a hospital or limited time at a skilled nursing facility (following a hospital stay). Part A also pays for some home health care and hospice care.

- Medicare Part B (medical insurance) helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental (Medigap) policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan (previously known as Part C) includes all benefits and services covered under Part A and Part B — prescription drugs and additional benefits such as vision, hearing, and dental — bundled together in one plan.

- Medicare Part D (Medicare prescription drug coverage) helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium.

Medicare Part B Options

You can sign up for Medicare Part A (hospital insurance) and Part B (medical insurance). Because you must pay a premium for Part B coverage, you can turn it down.

If you’re eligible at age 65, your initial enrollment period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didn’t sign up for it, unless you qualify for a "Special Enrollment Period" (SEP).

If you don’t enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a “general enrollment period” from January 1 through March 31. Your coverage begins on July 1 of the year you enroll. Read our Medicare publication for more information.

If you have medical insurance coverage under a group health plan based on your or your spouse's current employment, you may not need to apply for Medicare Part B at age 65. You may qualify for a "Special Enrollment Period" (SEP) that will let you sign up for Part B during:

- Any month you remain covered under the group health plan and you or your spouse's employment continues.

- The 8-month period that begins with the month after your group health plan coverage or the employment it is based on ends, whichever comes first.

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can

contact us, and we can discuss your options.

How To Apply Online For Just Medicare

Original Source ssa.gov

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

Want someone to help walk you through the process over the phone? Give Renee a call at 727.600.0850! Renee is a Medicare specialist with over 10 years of experience helping seniors navigate the complexity of medicare.gov and all your options.

Advantage Plans

Health Maintenance Organization (HMO) Plans

In HMO plans, you usually must use providers from within the network, regardless of whether that is convenient to you or not, except:

- Emergency care

- Out-of-area urgent care

- Out-of-area dialysis

Even when you have out-of-network benefits, it's cheaper for you to go to network providers.

You have to get a referral before you can see most specialists in an HMO. However, you don't need a referral for certain services, like yearly screening mammograms. If your doctor or other health care provider leaves the plan, your plan will notify you. You will have to choose another doctor in the plan. It's important that you follow the plan's rules, to avoid unexpected out-of-pocket costs.

Preferred Provider Organization (PPO)

A Medicare PPO Plan is a type of Medicare Advantage Plan (Part C) offered by a private insurance company. Many Medicare beneficiaries choose to enroll in PPO Plans because they want the freedom to go out of network. However, if you choose one of these plans, it's important that you understand what this choice means.

PPO plans are a good option if you like to have more of a choice on where to see your doctors and specialists. You can get care from any doctor, facility, or supplier that accepts Medicare in or out of network. Please note, if you are out of network, you may have higher copays.

Doctors and hospitals will know they will get paid promptly for the care they provide. This gives them an incentive to provide prompt, high-quality care. You have the flexibility to go to medical professionals you know and there are several different health insurance plans to choose from.

In most cases, prescription drugs are covered in PPO Plans. Your

medicare specialist can help you pick the right plan based off of your perception drug needs.

Private Fee-for-Service (PFFS) Plans

Medicare Advantage Plans (PFFS) are a type of health plan that can be offered by private insurance companies under Medicare. PFFS plans aren’t like Original Medicare or Medigap; the plan itself decides how much it will pay your doctors and hospitals, and how much you have to pay if you use those doctors or hospitals.

In some cases, you get your health care from any doctor, other health care provider, or hospital in PFFS Plans.

If you get sick or need to go to the hospital, you can see any of our health care providers who have agreed to always treat plan members. You can also see out-of-network providers who accept the plan's terms, but your costs will usually be lower if you stay in the network.

If you’re covered by a PFFS Plan or Medicare you get drug coverage at no extra cost. If your PFFS Plan doesn't offer drug coverage, you can join a Medicare drug plan (Part D) to get coverage.

Show your plan membership ID card each time you visit a health care provider. You can’t use your red, white, and blue Medicare card to get health care because Original Medicare won’t pay for your health care while you’re in the Medicare PFFS Plan. Keep your Medicare card in a safe place in case you return to Original Medicare.

Medicare Supplement Plans

If you are like most seniors, you rely on Medicare to prop up a retirement budget. The truth is that Medicare only covers roughly 80% of your expenses leaving you responsible for the remaining 20%. This can be devastating when there is a major medical need.

Fortunately, there's a better way to manage healthcare costs through a Medicare Supplement plan.

With a Medicare Supplement plan you can have the freedom to choose your doctors. You can avoid referrals that are typically required to see a specialist. You will have predictable out-of-pocket expenses for Medicare-covered services. You Get nationwide coverage, and you are guaranteed renewability. The insurance company can never drop you or change your coverage due to a health condition.

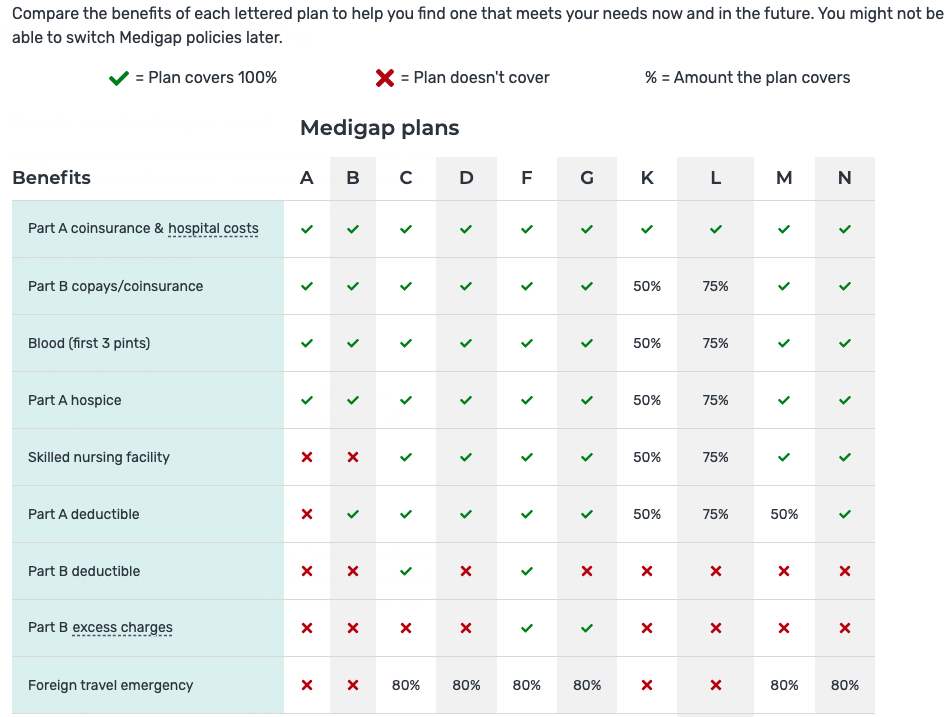

Check out your plan options below.

List of Services

-

Plan CItem Link List Item 1

Advantage plans (see above) are also called plan C. These plans are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, you still have Medicare. These "bundled" plans include Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance), and usually Medicare drug coverage (Part D).

-

Plan DItem Link List Item 2

Plan D helps play some of the costs original Medicare doesn’t cover, which are mostly copays, coinsurance, and deductibles, It only works with Original Medicare, and you must have both Parts A and B to enroll.

-

Plan FItem Link List Item 3

One of Plan F’s main advantages is that, unlike some other plans, it will cover all of your Medigap benifits. For example, Medigap Plan F covers your Part B deductible and Part B excess charge.

Note: Plan F is not available to people who were newly eligible for Medicare on or after January 1, 2020.

-

Plan GItem Link

The G Plan is the replacement plan for plan F. Plan G benefits are the same as Medigap Plan F except that the Medicare Part B deductible must be paid out-of-pocket.

-

Plan KItem Link

Medicare Plan K covers 50% of the other gaps in Medicare and the Part A hospital deductible.

-

Plan LItem Link List Item 4

With Medigap Plan L, insurance will pay 75% of your covered medical expenses, and you will pay the other 25%.

-

Plan MItem Link

You can reduce your monthly premium however, you will pay half of your hospital deductible and all of your outpatient deductible.

-

Plan NItem Link

Plan N pays 100% of the Part B coinsurance, except for a copayment for office visits and up to a $50 copayment for emergency room visits.

Medicare Supplement Plan Comparison Chart

Courtesy of medicare.gov

Ask questions. Discuss options. Talk to an expert.

Servicing

Florida, Missouri as well as most of the United States

CONTACT

8801 River Crossing Blvd, New Port Richey, FL, 34655, United States